【渥太华卖房】在加拿大如何顺利出售带租客的房产,作为屋主你需要注意哪些?

【渥太华卖房】在加拿大如何顺利出售带租客的房产,作为屋主你需要注意哪些?

目前的市场利率高涨,很多房东都苦不堪言,每个月的租金根本不够支付房贷和地税保险的费用,每月都要从自己的口袋里贴钱。渥太华房价呢,在高涨的利率下也短期内也没有上涨的可能。最近很多房东客户都来问我带着租客要怎么卖房?

1.联系你的租客,暗示一下目前自己的财政有困难,不得不放弃这个房子,近期会考虑卖房。你可以给租客提供两个选择,要么他现在去找一个新房子,你可以补偿他一个月的租金,也可以提供很好的推荐信给他未来的房东。如果他从现在起任何一个时间找到房子都可以搬走,你会按剩余的天数把付过的租金退给他。

2. 第二个选择呢是他可以选择继续住在里面,房子上市后如果有人来看房,经纪会提前至少24小时给租客通知,希望租客能配合一下收拾屋子并在被通知的时间离开房子方便让买家和经纪看房。

如果租客在接到通知后并没有积极地找房子,而选择了继续居住,那在你房子上市的前几天最好亲自去房子一趟,给租客送点小礼物给点好处,把关系搞好。这样租客才愿意配合看房。 租客的居住状态对房子的出售情况是起着非常大作用的,卖房子最好的状态就是在上市期间没有人住在里面,该修修该刷墙的刷墙,做深度闪闪发亮的那种清洁,然后我们经纪会把房子打扮的漂漂亮亮的,让人一进来就眼前一亮,这样才能抓住买家的心理,把房子卖个好价钱,而且还能让房子出售地很顺利,不会来来回回地在市场上挂很长时间。

第二理想的状态呢,就是你的现租客生活比较讲究,屋子里井井有条,虽然我们不能挪动和改变房客的家居装饰,但是租客愿意配合卖家在有人来看之前收拾一下杂物把房子整理到至少是整洁的状态。这个时候上的盘呢,照片肯定是没有做过设计和装扮的好看,但至少还是会有人来看的。这个状态的房子,要想吸引人来看,价格一定要标的吸引人,除非你的房子有很大的优点或很稀缺,挂盘时状态又不好价格又略高的房子是不会有很多人想来看的。即使来的话也是和其他在售的房子比比,把这个房子当成一个对比对象去下别的房子的单。

如果租客住里面,挂盘呢还有一个非常重要的点需要注意:尽可能地和你的租客签一个N11, 目前的市场并不是房源非常短缺的,除非买家非你的房子不可。如果现租客没有一个明确的搬家日期的话,买家是不会想要接手一个烫手山芋的。即使下了单,买家也会在合同里要求卖家在交接之前把房客清走。那到这个时候呢,房客知道你是非要他搬走不可了,很可能会趁机敲你个竹杠,我们今年就有这样的一个房东,由于挂盘之前没能和租客达成一致,卖家又着急想卖房子,最后房子卖掉了不得不让房客搬家的时候,房客开口要了3万,最后协商到两万,一个交钱一手交钥匙。

其实像这样的案例呢,最好就是在挂盘之前就把房客的问题处理清楚先,争取能让房客搬走再卖。如果时间不允许,就一定要签个N11。无论是用什么代价,提前签总比最后被人掐着脖子签要好。

这个时候其实就是体现房东和房客之间的关系了,如果你平时和租客的关系融洽,房子有什么问题及时处理,事事有回应,那你的租客就会愿意搬走。

再有一个就是如果你在找租客的时候就审核地很严格,租客是个受过教育收入稳定且通情达理的人的话,他也会愿意配合你卖房。这就是为什么房子不能随便租,宁可空着也要租给好房客,就是因为一旦租给了一个不合格的租客,这个租客可能住一辈子也不想搬家,他也很难再找到其他的房子。

总结下来就是,首先联系你的租客,先预先通知一下再给书面的通知,然后根据房客搬家的计划,我们房产经纪可以配合,按照专业的方法去和房客沟通完成这个卖房全过程,直到你的房子顺利交接。

最后我想说的是,当房东有风险,找租客需谨慎。房子能带给投资人巨大的利润回报,当房东的需要不断地完善自己的专业知识,做到知法懂法,你的租客就会和你和平相处。

(本文由渥太华【红宝地产】原创,如需转载,请标明出处)

【渥太华买房】全市房价几乎全体下跌,不跌反涨的几个区域你需要知道

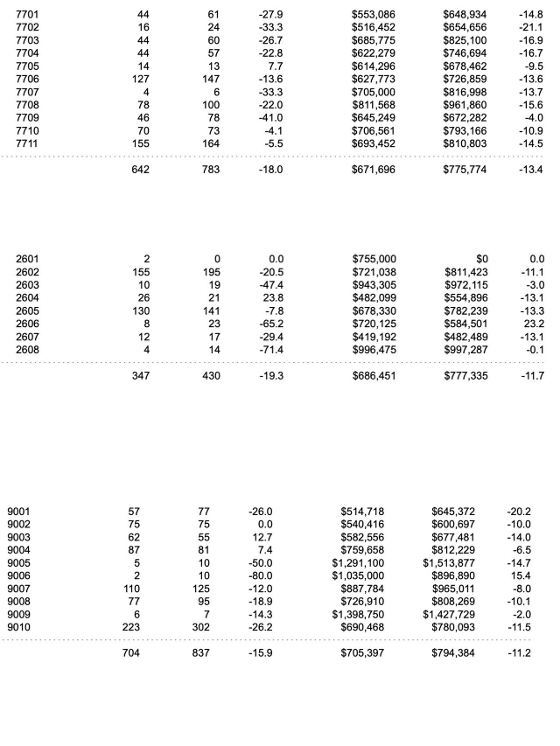

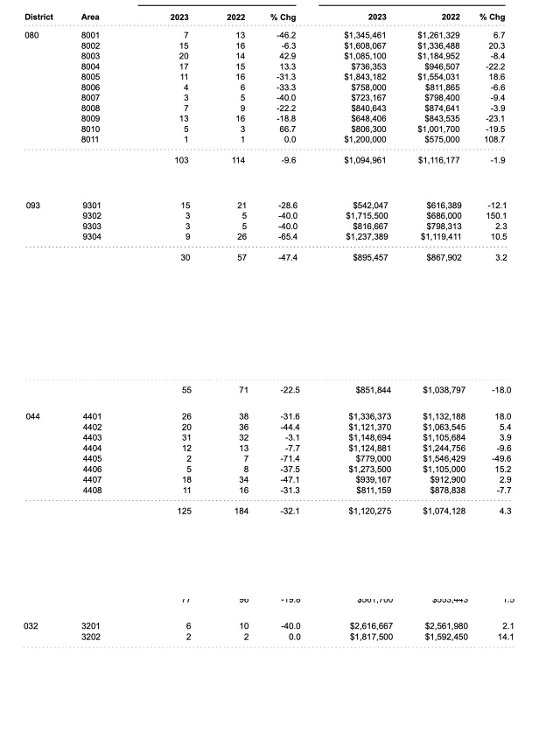

一年以来全市范围内房价几乎都是全体下跌,华人较多的社区Barrhaven/Kanata/RRS跌幅都是在百分之十几(图上77,90,26区域)但有些区域却是不跌反涨的,不会跟着市场的下滑而下滑,你知道是哪些区吗?

渥太华少有的几个不跌反涨的区域,有一个共同特点:均价都是渥太华最高 ,也就是说越高尚的社区,受市场影响越小.

首先是大地豪宅区,比如南部典型的ESTATE HOME区Manotick的Rideau Forest,西区的Dunrobin shore,(80和93区域)总之拥有很大一块地或好景观的小区房,受市场影响较小.

其次是市区内的一些经典社区,比如Glebe,Rockcliffe park, (44和32区域)这些区域是西人比较追捧的,半个世纪以前就是豪宅区,本地人以住在这些区域为荣,居民具有一些排他性. 这些区域受市场价格影响也不大.

大数据都是比较笼统的,需要判断每个小区的精确数据才会对买房和卖房起到帮助. 目前的市场是卖房艰难的时期,买房捡漏的时期,需要根据不同区域的特征和走向去制定方向.

如果您有渥太华房产需求,欢迎联系 【红宝地产】!

渥太华房价【红宝地产】2023.6月房市数据报告

转眼加息已经9次了,我记得去年的6月是最后一批成交到高价的一批,之后一路下跌,直到今年的2月才停,3-5月涨了三个月,6月政府又开始加息. 房产市场跟着每次利率调整,非常直接地给出反应.

一年以来,渥太华的市场经过起伏,平均价从平均跌幅最大的-17%,到目前的同比-3.5%,足以证明渥太华房市的潜力和力量. 尽管利息一路攀升,但购房需求还是在一路增加的,无论是买房还是租房,可以明显感觉到新人的涌入.

挂盘量方面,今年6月比去年6月少了14%,可以看出渥太华的房产持有者的态度,稳定的收入支撑了继续持有的底气,虽然每月都是负现金流,但房东们明白,紧一紧裤腰带,守得云开见月明.

Ottawa Real Estate - June Stats (2023)

June’s Resale Market Eases into Summer

Members of the Ottawa Real Estate Board (OREB) sold 1,658 residential properties in June through the Board’s Multiple Listing Service® (MLS®) System, compared with 1,493 in June 2022, an increase of 11%. June’s sales included 1,234 in the freehold-property class, up 10% from a year ago, and 424 in the condominium-property category, a 16% increase from June 2022. The five-year average for total unit sales in June is 1,881.

“Although June’s transactions surpassed last year’s, the number of sales, average prices, and new listings declined on a week-to-week basis over the course of the month. Compounded by the typical summer decline in activity, the Bank of Canada’s interest rate adjustment at the beginning of the month may have also flattened the curve,” says Ottawa Real Estate Board President Ken Dekker.

By the Numbers – Average Prices*:

- The average sale price for a freehold-class property in June was $746,445, a decrease of 4% from 2022, but still on par with May 2023 prices.

- The average sale price for a condominium-class property was $448,380, an increase of 2% from a year ago and up 1% over May 2023 prices.

- With year-to-date average sale prices at $731,847 for freeholds and $432,885 for condos, these values represent a 10% decrease over 2022 for freehold-class properties and a 7% decrease for condominium-class properties.

“Supply is trending in the right direction. The increase in inventory is encouraging and indicates sellers have confidence in the market. A growing resale housing stock will result in more selection for buyers and more sales,” Dekker suggests.

By the Numbers – Inventory & New Listings:

- June’s new listings (2,758) were 14% lower than June 2022 (3,212) and down 2% from May 2023 (2,822). The 5-year average for new listings in June is 2,802.

- Months of Inventory for the freehold-class properties has increased to 2.1 months from 1.9 months in June 2022 and 1.5 months in May 2023.

- Months of Inventory for condominium-class properties has decreased to 1.4 months from 1.6 months in June 2022, although up from 1.3 months in May 2023.

- Days on market (DOM) for freeholds stayed on par with last month at 23 days and increased to 27 days for condos compared to last month (26 days).

“We are looking forward to a strong second half of 2023 in terms of sales volume and prices compared to last year. Whichever side of the transaction you are on, the advice of a professional REALTOR® who has their pulse on the week-to-week variabilities in Ottawa’s resale market is priceless.”

REALTORS® also help with finding rentals and vetting potential tenants. Since the beginning of the year, OREB Members have assisted clients with renting 3,336 properties compared to 2,919 last year at this time, an increase of 14%.

(SOURCE: OREB)