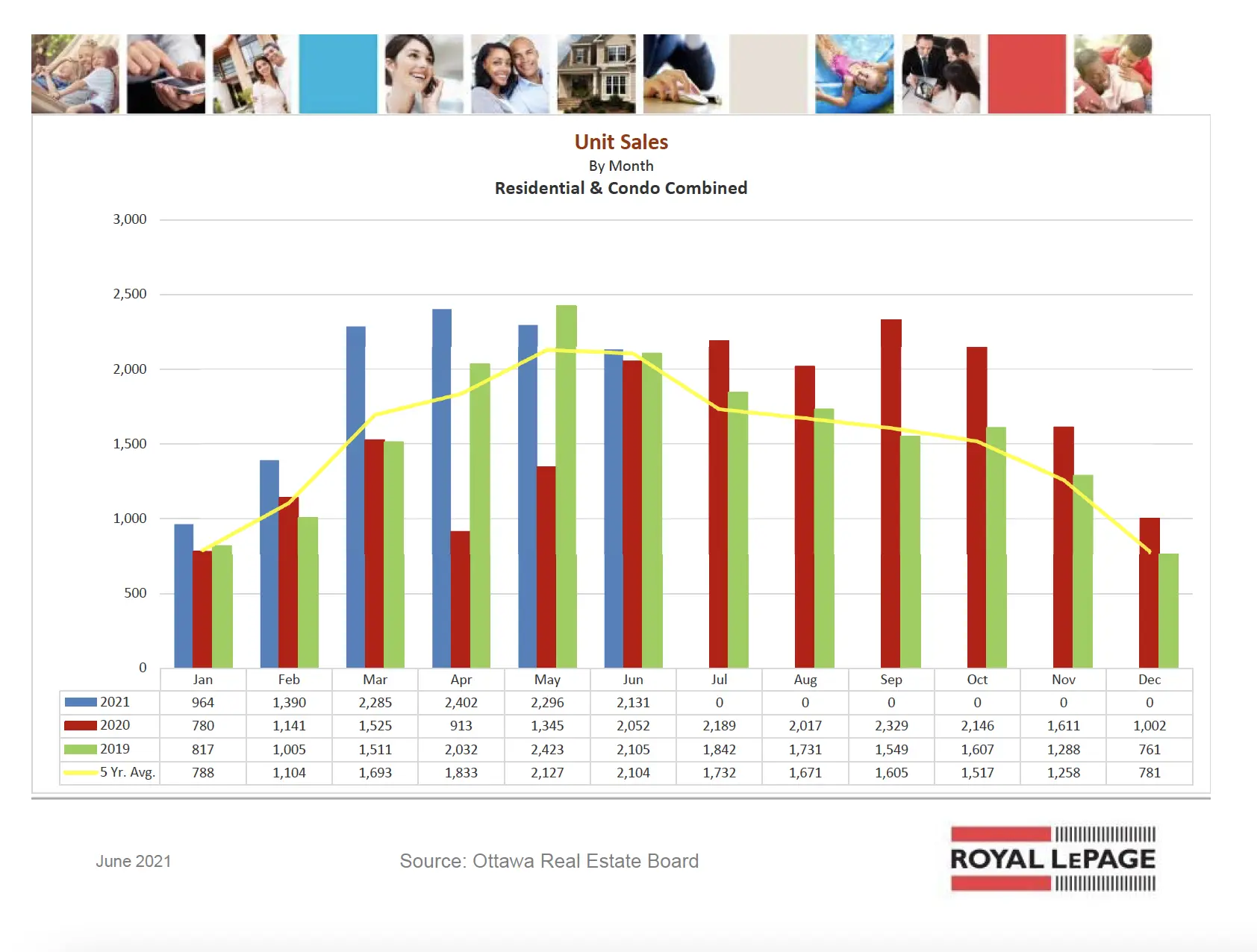

Members of the Ottawa Real Estate Board sold 1,889 residential properties in April through the Board’s Multiple Listing Service® System, compared with 2,394 in April 2021, a decrease of 21 per cent. April’s sales included 1,419 in the residential-property class, down 23 per cent from a year ago, and 470 in the condominium-property category, a decrease of 13 per cent from April 2021. The five-year average for total unit sales in April is 1,849.

“With the number of transactions just slightly over the 5-year average, this was one of the weakest performing Aprils we have seen in a while,” states Ottawa Real Estate Board’s President Penny Torontow. “Considering that the number of new listings increased last month, it is a bit of a surprise that sales were off.”

“Certainly, there are a few factors at play: rising interest rates, growing Buyer frustration, April’s cooler temperatures, as well as the housing supply measures recently announced by the government – these could all be causing Buyers to pull back with a wait-and-see approach. We are watching the rest of the spring market closely to determine if this could perhaps be an early indicator of a shift in the market. Since April is only one month, we will be monitoring to see if it becomes a trend moving forward.”

“The fact remains that it is still a Seller’s market with supply under one month. Bidding wars and multiple offers persist in some pockets, prices continue to rise, albeit more moderately, and the market remains relatively strong,” she adds.

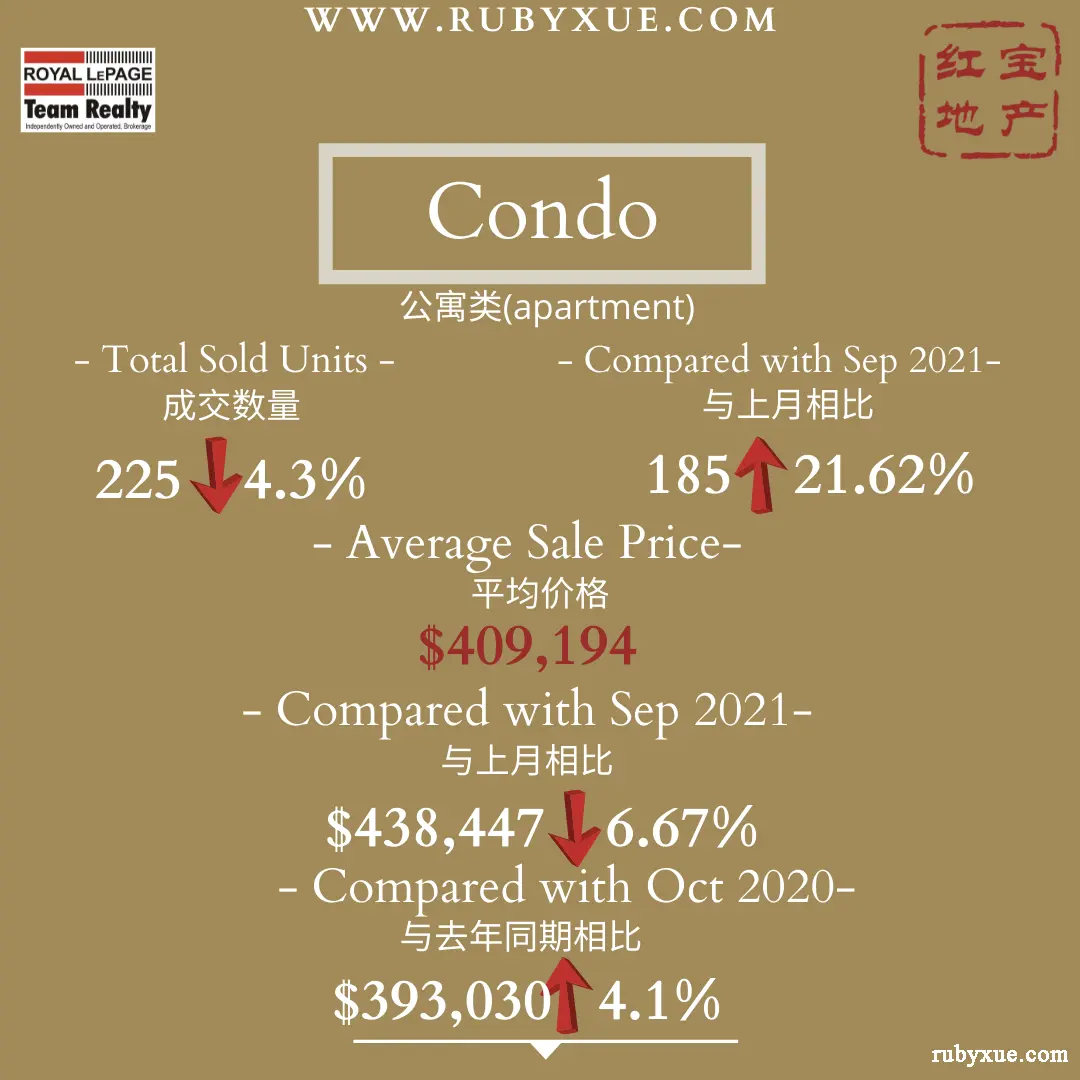

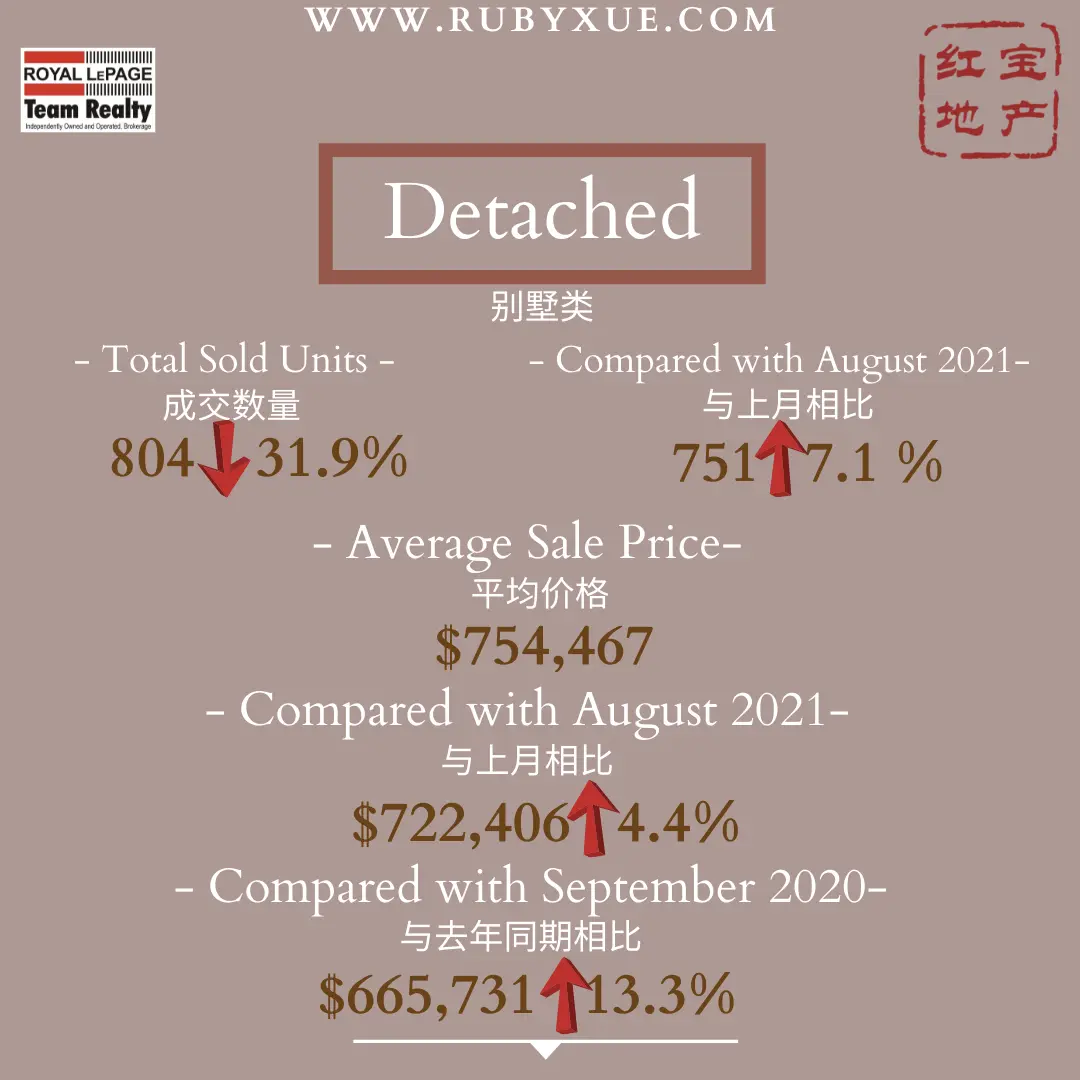

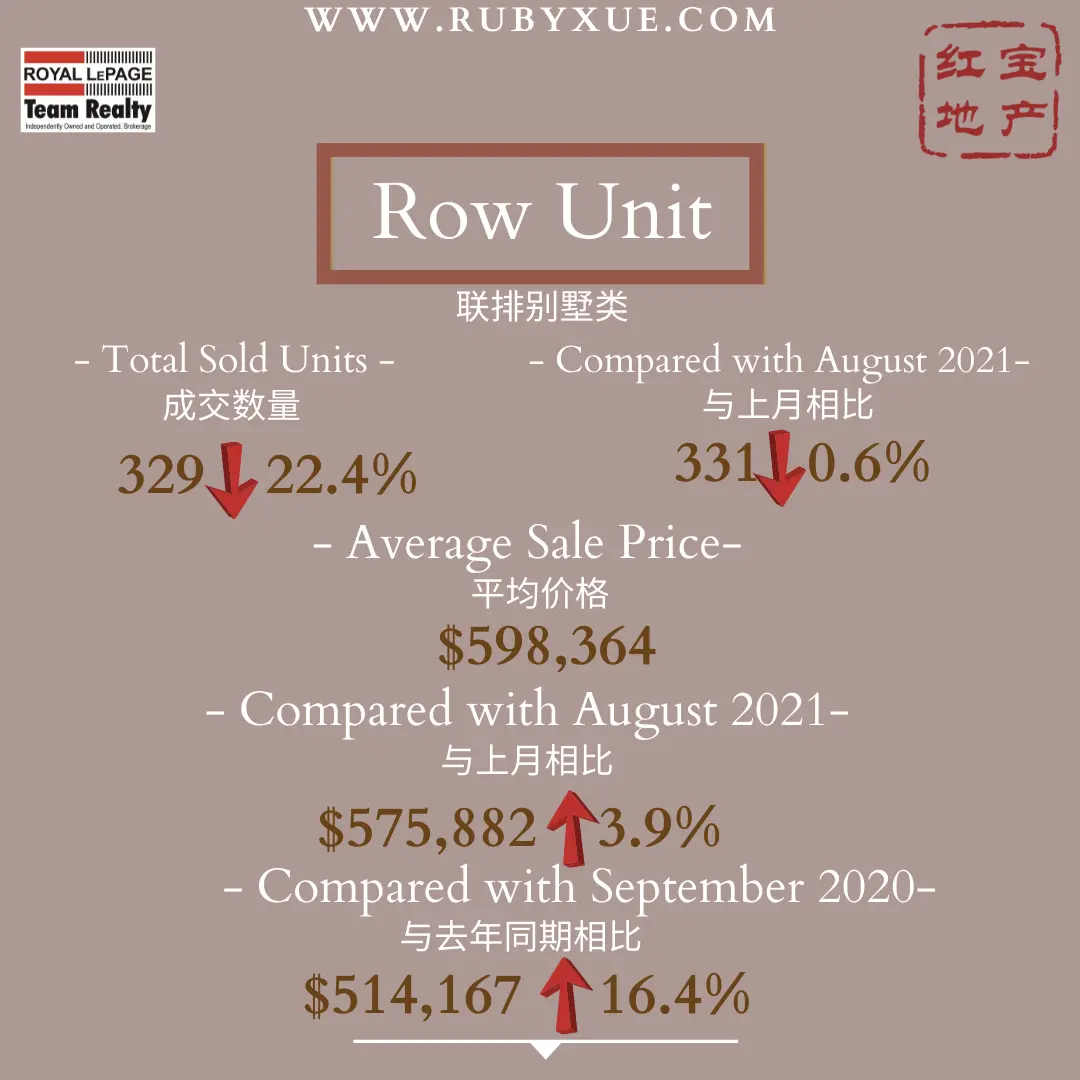

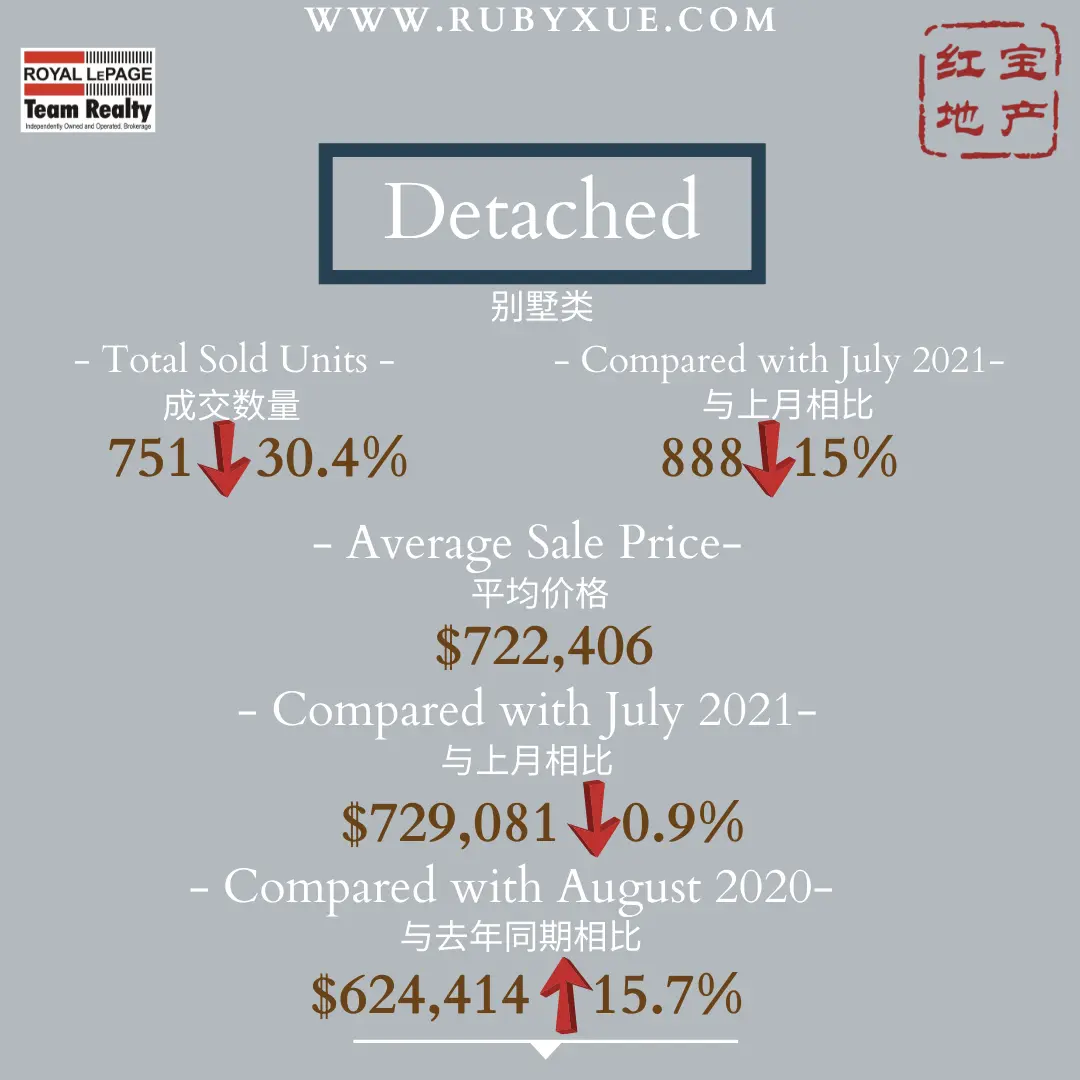

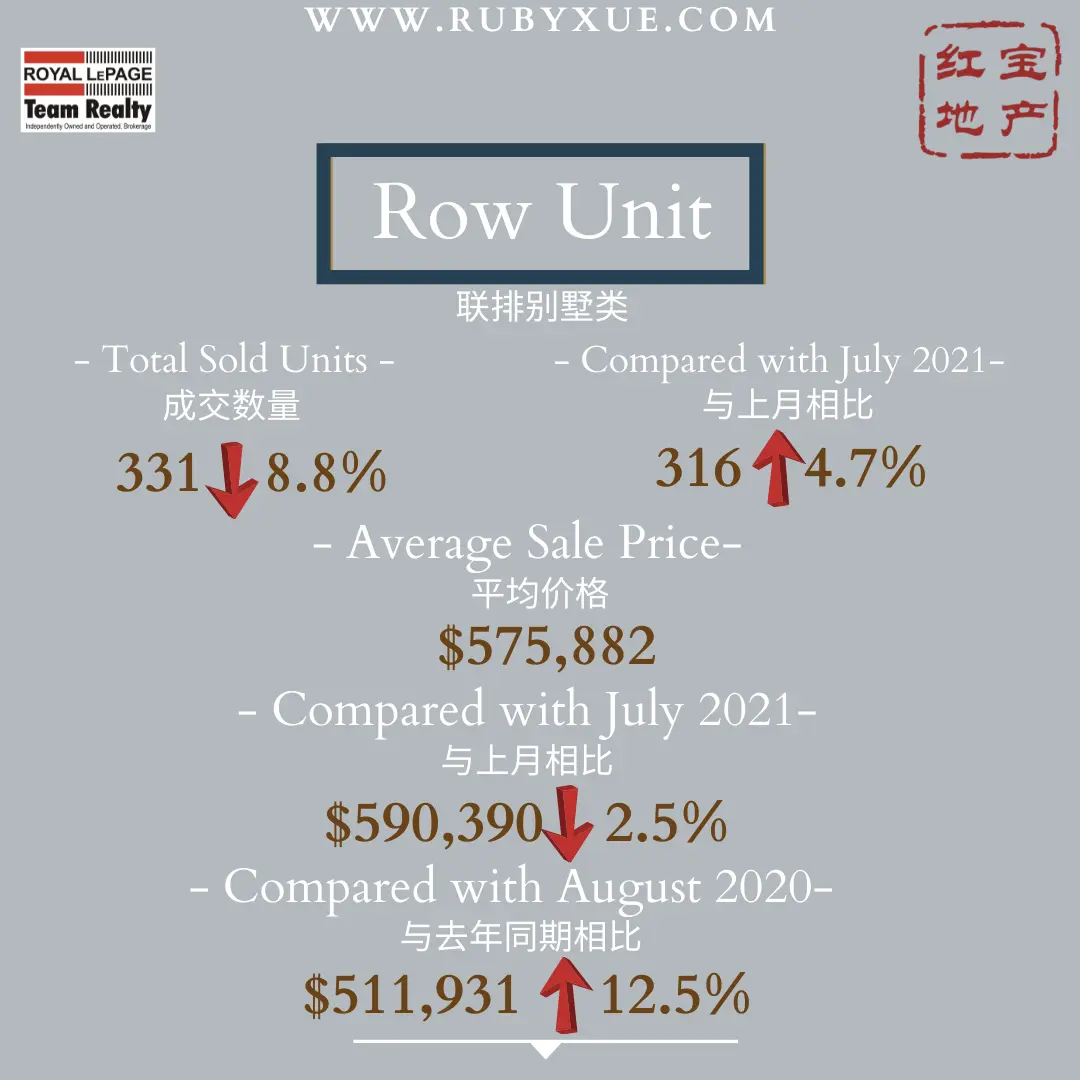

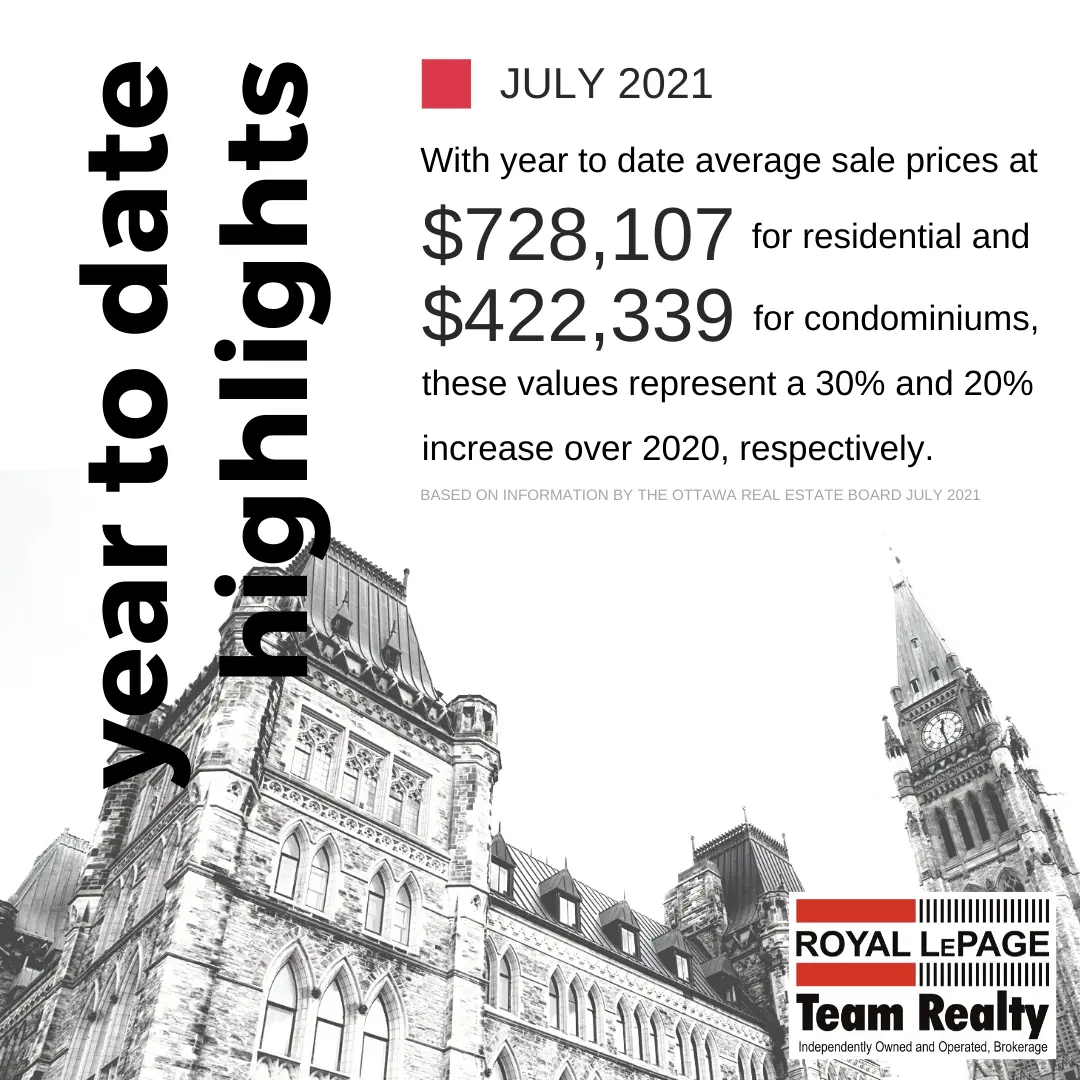

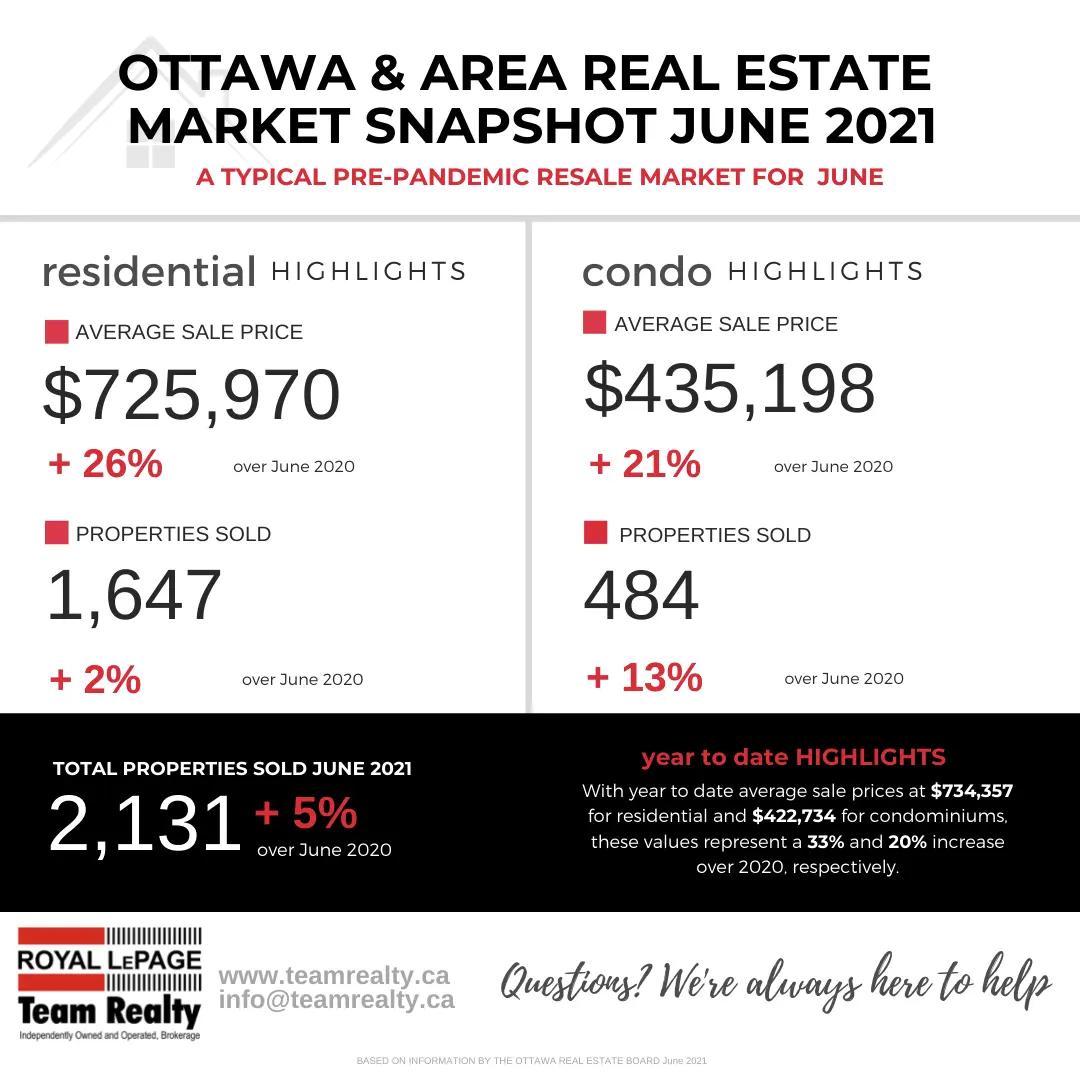

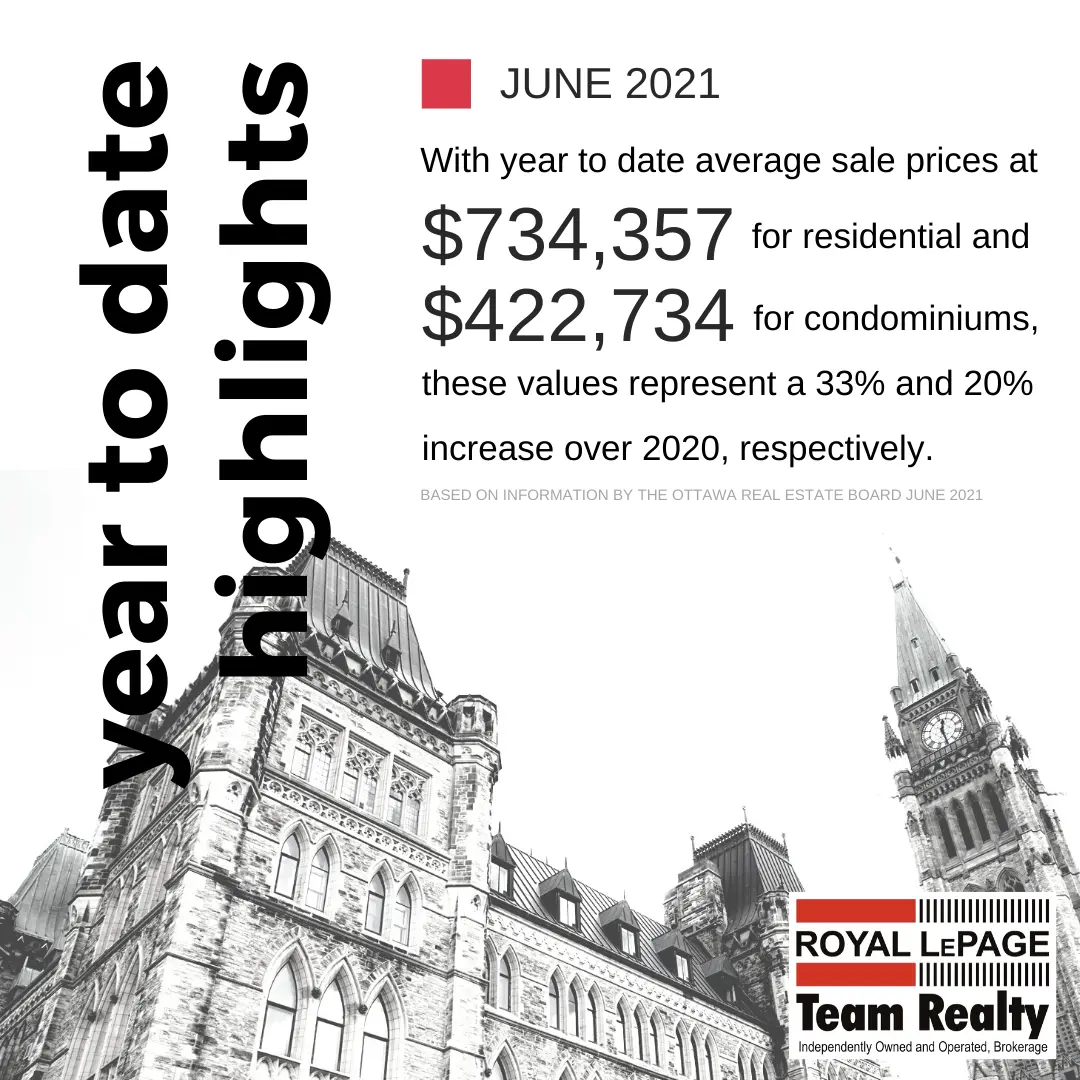

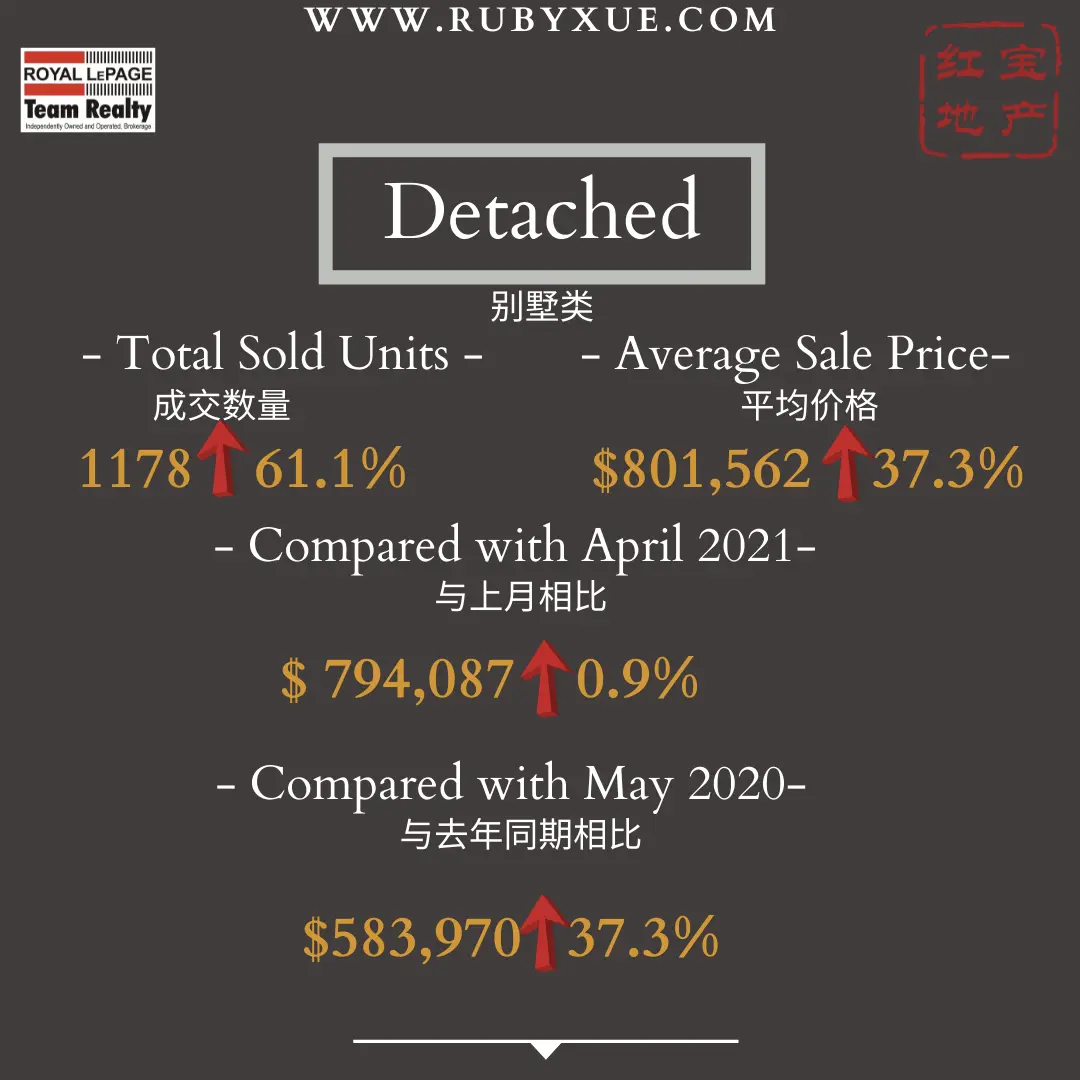

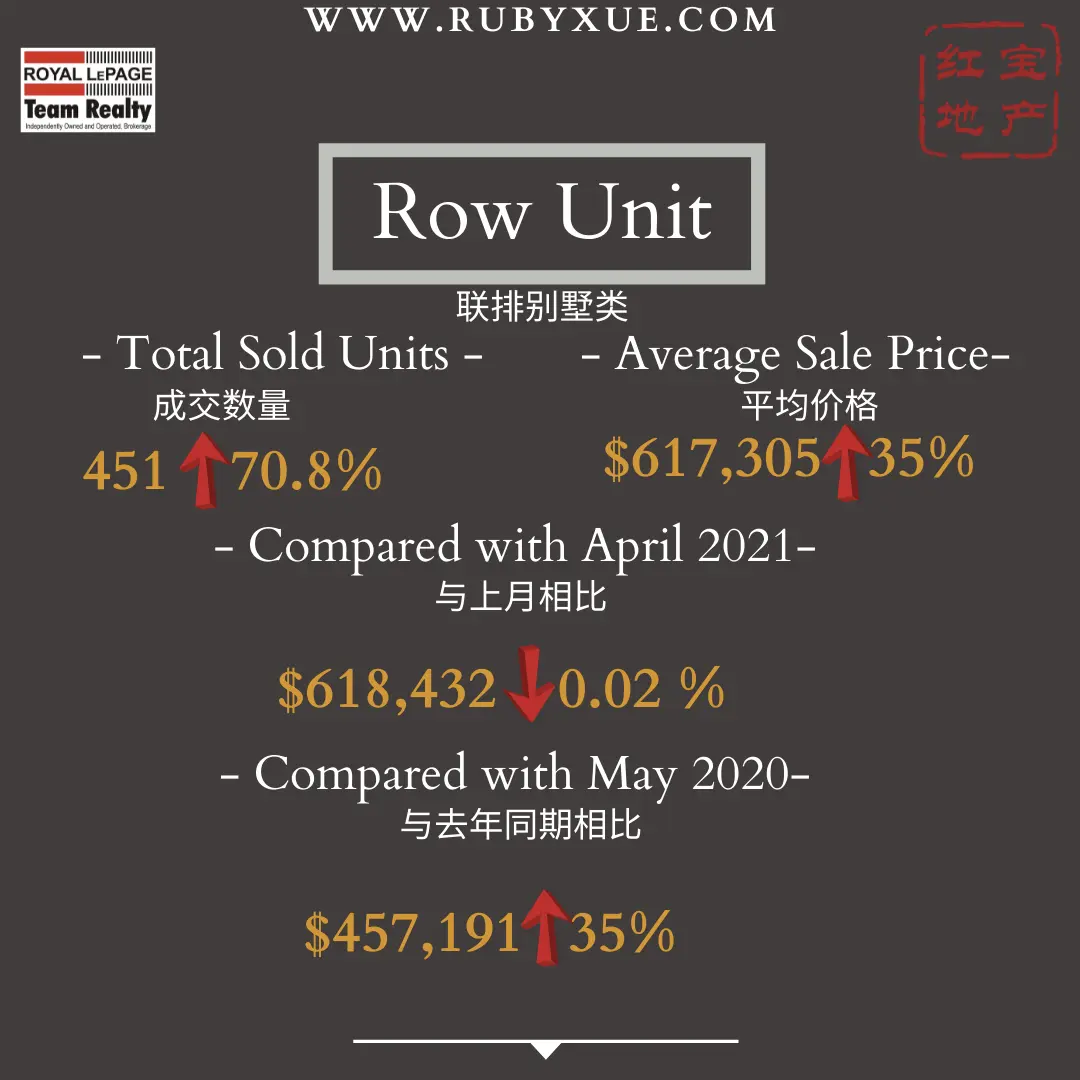

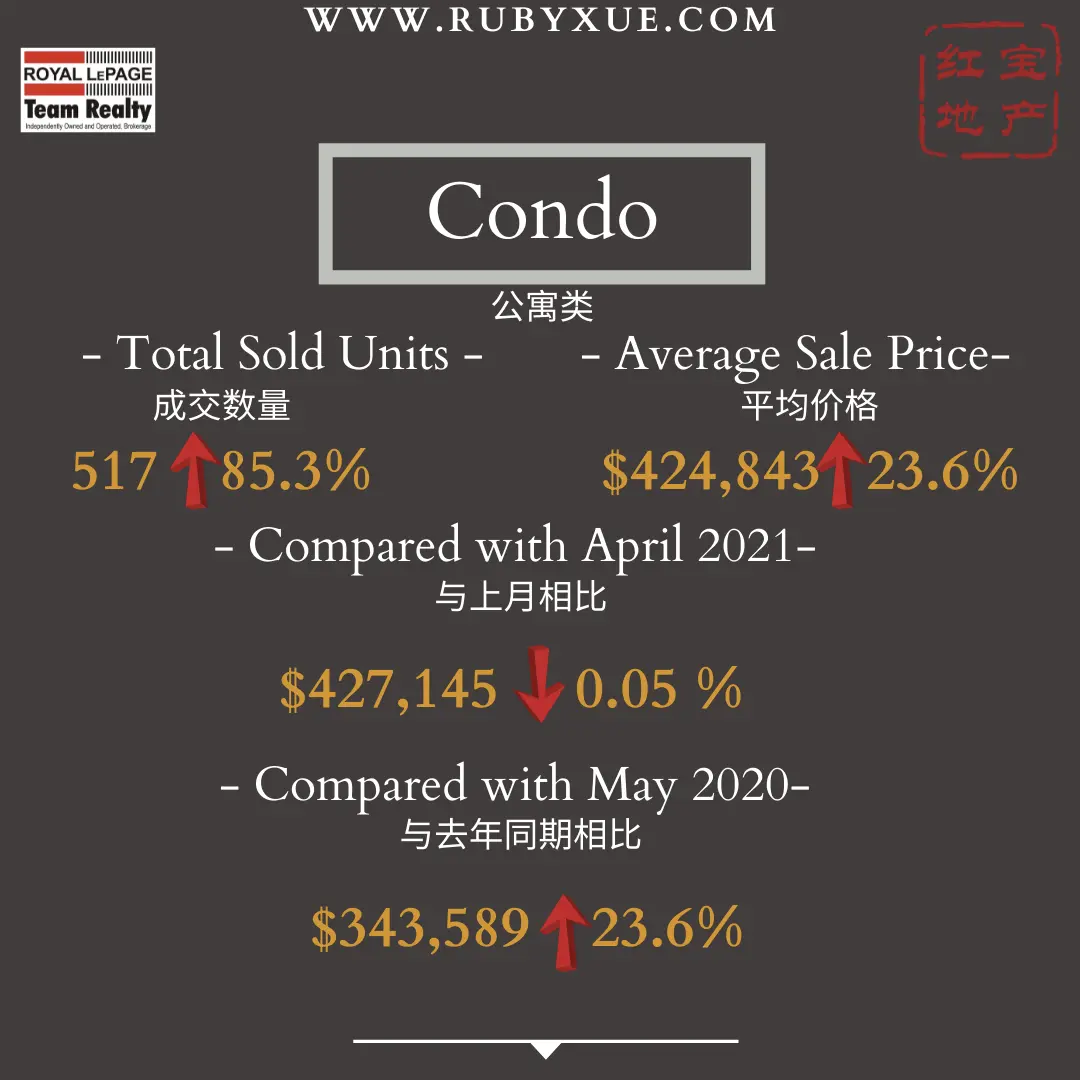

The average sale price for a condominium-class property in April was $473,702, an increase of 11 per cent from 2021, while the average sale price for a residential-class property was $829,318, increasing 12 per cent from a year ago. With year-to-date average sale prices at $830,588 for residential and $469,603 for condominiums, these values represent a 13 per cent and 12 percent increase over 2021, respectively.*

“Limited supply and high demand will continue to place upward pressure on prices. And as long as there are Buyers willing to pay, average prices will reflect the inventory shortage. However, it is conceivable that price growth may moderate as we do not see the level of price escalations that occurred earlier in the pandemic,” Torontow suggests.

“Although the number of new listings in April (2,846) was down by 11% from 2021, the number of properties that entered the market was still 10% over the 5-year average (2,600), and 214 units more than what was added to the housing stock in March. This has increased Ottawa’s months of inventory to just under a month’s supply. In March, it was just over two weeks. This is good news for potential Buyers as they will have more options and more opportunities to enter the market.”

“In fact, the condominium market may be performing slightly better than residential property classes due to the fact that they are the most affordable price point to enter the market and could possibly now be considered the new entry-level property type.”

“We have also noticed a marked increase in the number of rental properties listed on the MLS® System. Since the beginning of the year, OREB Members assisted clients with renting 1,786 properties compared to 1,458 last year at this time. An increase of 23% and almost double the quantity recorded in pre-pandemic years. As for lease prices, the average cost for a 1-bdrm is approximately $1,850, and a 2-bdrm is $2,200 for rentals listed on the MLS® System. These values are roughly 3-4% higher than this time in 2021. Ottawa REALTORS® are an excellent resource when it comes to finding a rental property or vetting tenants – contact one today!”

(SOURCE: OREB)